We have been witnessing low interest rates on home loans in India like never seen since 2020. There are multiple other factors to consider e.g. Reduction in stamp duty, purchase decisions on hold due to COVID 19 restrictions, competitive rates due to pandemic etc. Prolonged work from home and school from home have also prompted customers to either buy their first home or upgrade their existing home (larger homes not necessarily in erstwhile prime locations).

Now that the second wave of COVID 19 has been largely tamed, restrictions lifted and interest rates still in the range of 6.5% – 9.25%, is it a good time to invest in residential property?

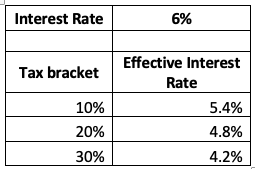

Apart from lower interest rates, tax deductions on repayment of loans makes buying a house an attractive decision especially for people in the higher tax brackets. The tax benefit (deduction for the interest portion from the taxable income) also lowers the interest rate further.

Please refer to the table below for effective interest rate as per your tax slab :

Below are the tax benefits (per current tax rules) on the loan repayments of home loans (self occupied) –

Considering the lower interest rates and tax benefit, it is very attractive decision to buy a house at this time. First time home buyers also get additional tax deduction of ₹ 50 thousand for interest portion (Provided home loan amount doesn’t exceed ₹ 35 lakhs and value of the house is upto ₹ 50 lakhs). Also, if you are a first-time buyer, the satisfaction you will derive from living in your own house is invaluable.

However, in case you own a house already and are buying a house as an ‘investment’, the important factor to be considered is the risk and reward of an investment. The risks involved in real estate investment are large capital locked for longer period of time and uncertainties involved (like natural calamities, litigations, non-liquid asset, economic uncertainties etc.). Rewards are in terms of money earned on the capital deployed are mentioned below:

1. Rental yield – The range of rents in tier I cities could be ₹ 25,000 – ₹ 50,000 depending on the locality, size and value of the house. Assuming an investment of ₹ 1.5 – 2.0 crores in an asset, the rental yield is less than 0.5%. Additionally we need to consider costs like maintenance, property tax, brokerage etc.

2. Capital appreciation – Capital appreciation in real estate can be substantial, but usually requires a longer time horizon resulting in your capital being illiquid for a longer time. Hence, one needs to consider this before locking their money.

So, if you are a first-time home buyer, then you can take tax benefit and enjoy living in your own house. If you already own a house and want to buy a house as an investment, consider your risk – reward before taking the plunge.

Excess inflow of funds (e.g. Bonus, salary raise, incentives or cash profits in business) can be deployed for loan repayment or investment elsewhere for better yields. Return on investment, safety of capital, certainty of future cash flows must be weighed before deciding utilisation of funds. Uncertain future cash flows indicate need for repayment as it reduces the burden of future liability. Better return on investment (ROI) and certainty of future cash flows are considered good indicators for investing as against repaying loans. Benefit from Returns on investments adds up to continuing tax deductions resulting in a win – win.

Investors who want an exposure to real estate despite limited capital, have other investment avenues (including alternative investments) with better risk – reward ratio. Few options include shares in realty sector (direct equity route) or mutual funds with exposure to real estate sector.

This could benefit retail investors in the following ways:

- Smaller investment amount required

- No burden of loan repayment

- Lesser holding periods, hence better liquidity

- Diversification strategy

Content is intended to be used and must be used as informational purpose only. It is advisable to do your own analysis before making any investment based on your own personal circumstances. I am not a registered investment, legal or tax advisor or broker / dealer. You should take independent financial advice from professional in connection with, or independently research or verify, any information provided in any article/s published on my LinkedIn page.