One of the pre requisites of a good portfolio is liquidity and a good mix of investments with differing maturities. It helps safeguard other illiquid assets and enables an investor to withdraw funds for short term requirements.

There are a handful of liquid assets like bank fixed deposits, debt oriented mutual funds, short term corporate deposits etc. The returns offered in these liquid assets are in the range of 5% – 7% p.a. Corporate deposits may offer a little higher rate (8.5% or 9%) depending on the risk appetite of the investor since these are generally unsecured in nature. The credit rating, financial position of the company etc. determines the interest rates i.e. higher risk will earn higher return.

A new product has recently surfaced with a better risk-reward ratio. Investors looking for short to medium term investments have alternative options being offered by one of the Fin-tech companies.

Faircent – a peer-to-peer (P2P) lending company offers Faircent Double, a fixed interest rate of 12% p.a. for 12 months (funds invested for 6 months will fetch 11% p.a.). This product pools funds from multiple investors to lend to borrowers with an established track record. It makes use of data analytics and scientific portfolio building approach to reduce risk. Thus, it leverages fund pooling (like mutual funds) and technology to reduce the risk for the investor.

Product features :

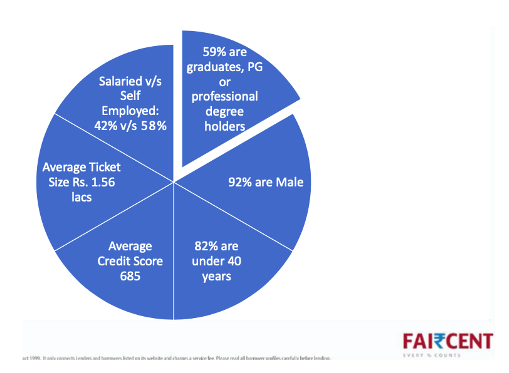

There are multiple factors implemented to reduce the risk. One of the important factors is borrowers are selected on fulfilment of certain criteria e.g. borrowers who have serviced loan in the past and majority of borrowers don’t have defaults in history. You can see the portfolio mix in the pie chart below :

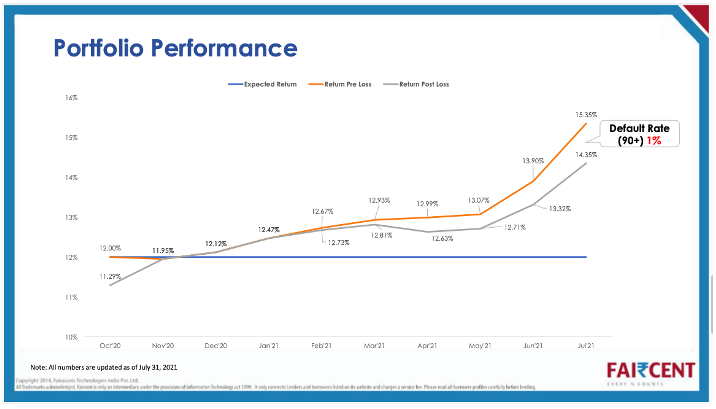

Portfolio performance has consistently improved and has been more than 12% for last 8 – 9 months as shown in chart below. This implies that an investor has been earning returns at committed rates for this period.

In conclusion, this is a technology enabled product offering good returns and requiring very little involvement from the investor (auto-pilot). It is an alternate investment product which investors can consider for fixed term investments while earning better return as compared to other debt products.